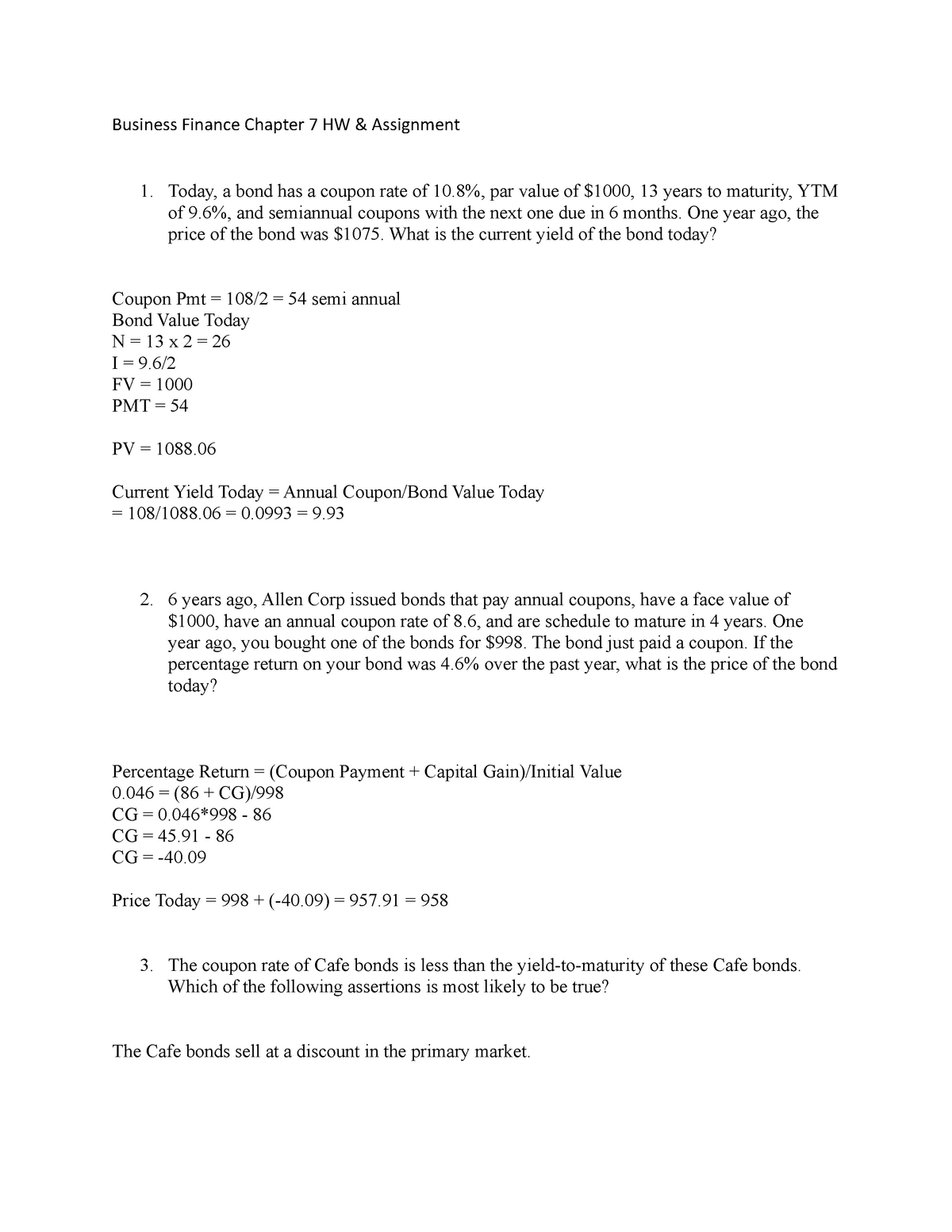

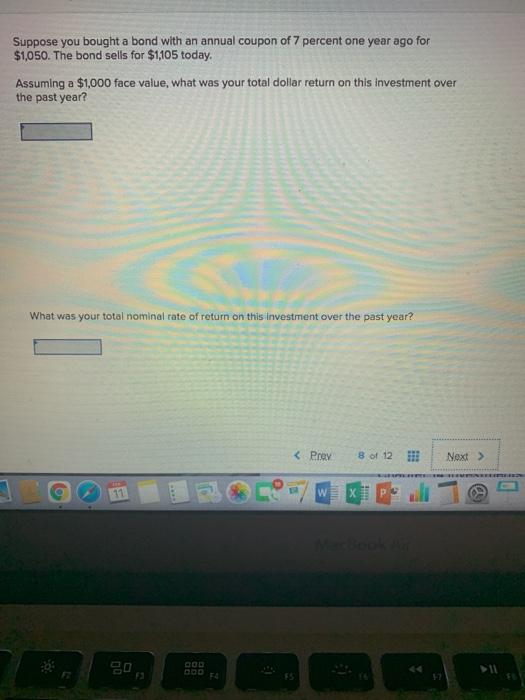

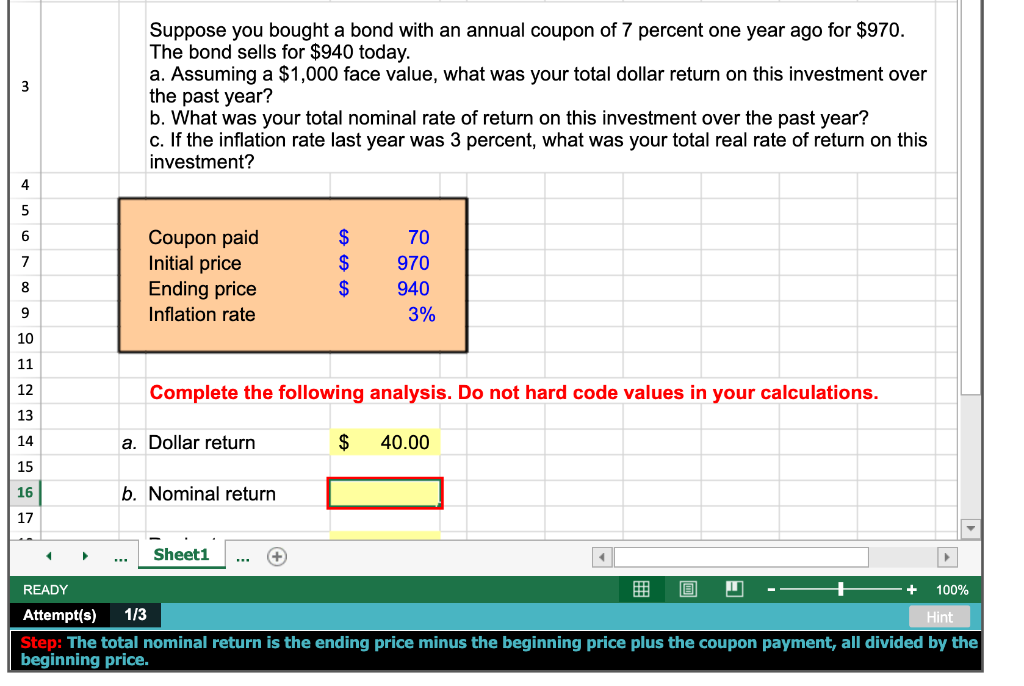

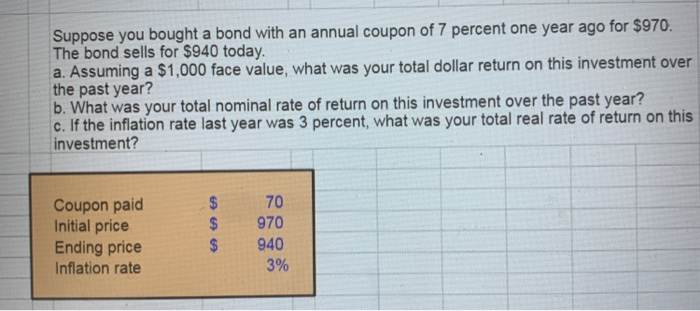

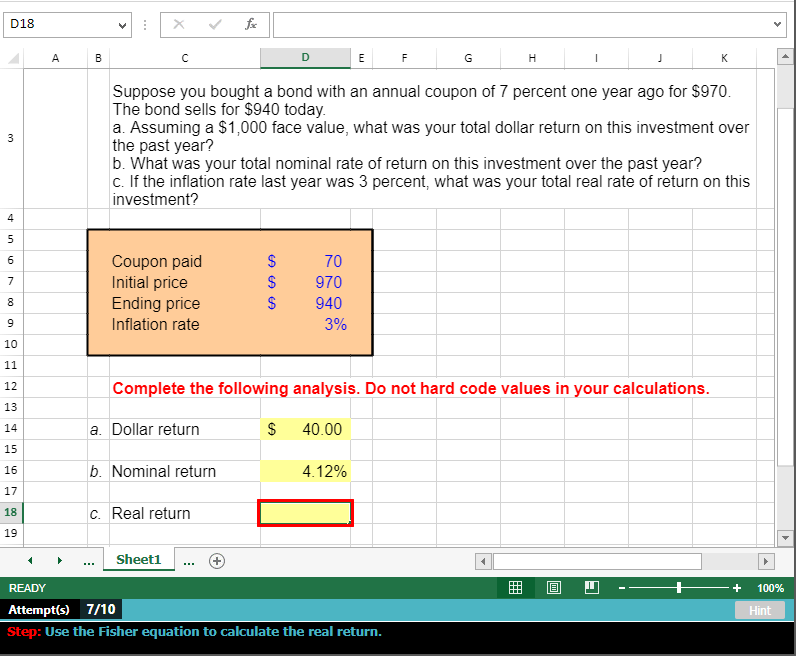

42 suppose you bought a bond with an annual coupon of 7 percent

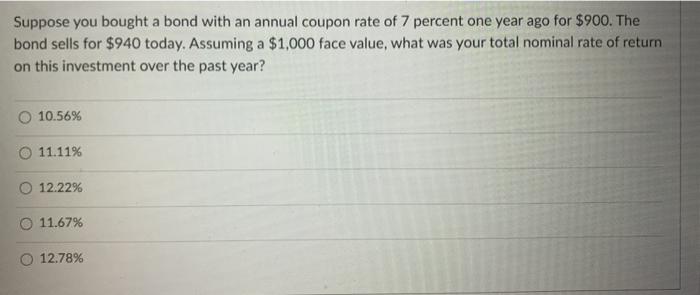

Suppose you bought a bond with an annual coupon rate of 7.5 percent one ... Suppose you bought a bond with an annual coupon rate of 7.5 percent one year ago for $898. The bond sells for $928 today. a. Assuming a $1,000 face value, - 20067138 Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a.Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b.What was your total nominal rate of return on this investment over the past year?

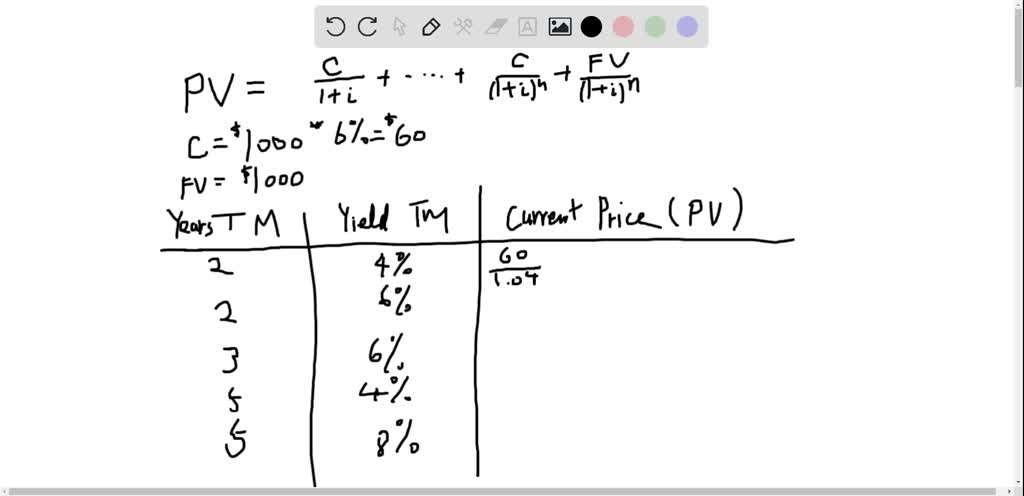

Chapter 10 Finance Flashcards | Quizlet To calculate the dollar return, we multiply the number of shares owned by the change in price per share and the dividend per share received. The total dollar return is: Dollar return = 270 ($82.84 - 76.33 + 1.45) Dollar return = $2,149.20 Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901.

Suppose you bought a bond with an annual coupon of 7 percent

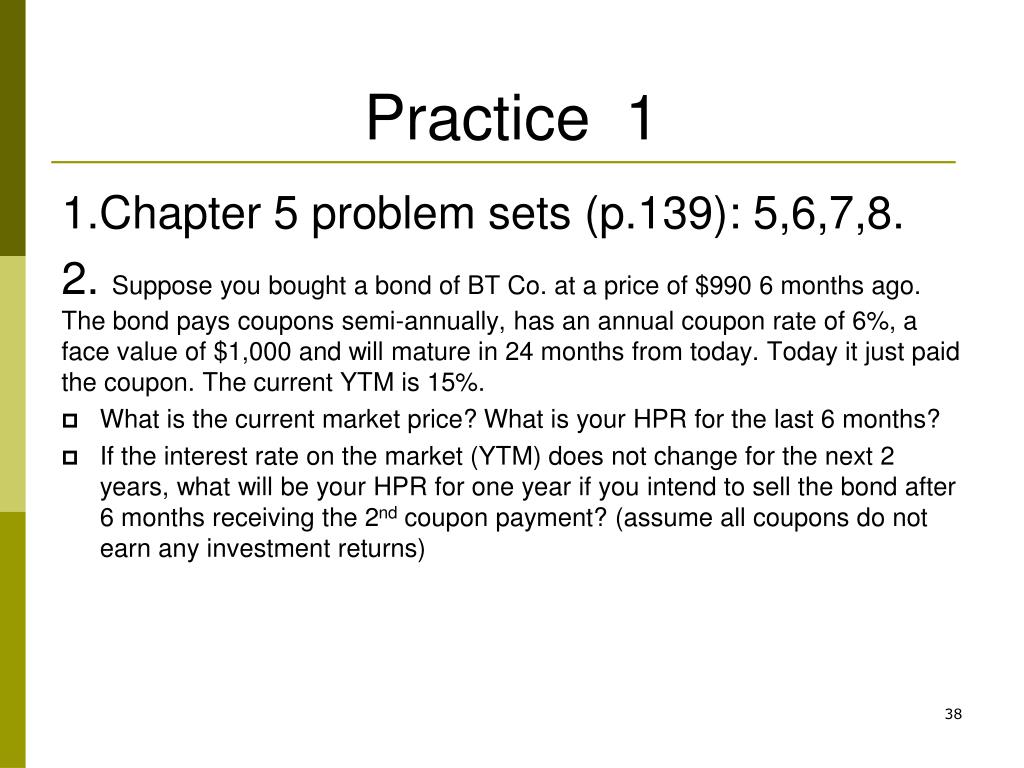

Chapter 7 Flashcards | Quizlet Suppose that today you buy a bond with an annual coupon of 7 percent for $1,090. The bond has 14 years to maturity. A) What rate of return do you expect to earn on your investment? Assume a par value of $1,000. B) What is the HPY on your investment? (your realized return is known as the holding period yield) 1.docx - Suppose you bought a bond with an annual coupon rate of 7.9 ... View 1.docx from FIN 737 at Columbus State Community College. Suppose you bought a bond with an annual coupon rate of 7.9 percent one year ago for $902. The bond sells for $936 Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year?

Suppose you bought a bond with an annual coupon of 7 percent. Question : Question Suppose you bought a bond with an annual coupon ... The bond sells for $905 today. a. Assuming a $1,000... Question Suppose you bought a bond with an annual coupon rate of 8.8 percent one year ago for $911. The bond sells for $954 today. a. Assuming... Q2uestion Suppose you bought a computer for $5,000 three years ago. It isdepreciated as a three-year property class, where the percentagesare 33. ... Finance Final Exam chapters 10,11,12,&13 Flashcards | Quizlet A bond had a price of $946.58 at the beginning of the year and a price of $982.90 at the end of the year. The bond's par value is $1,000 and its coupon rate is 5.9 percent. What was the percentage return on the bond for the year? Bond return= ($982.90 - $946.58 +59)/ $946.58 bond return= .1007, or 10.07% chapter 10 quiz Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? 1.docx - Suppose you bought a bond with an annual coupon rate of 7.9 ... View 1.docx from FIN 737 at Columbus State Community College. Suppose you bought a bond with an annual coupon rate of 7.9 percent one year ago for $902. The bond sells for $936

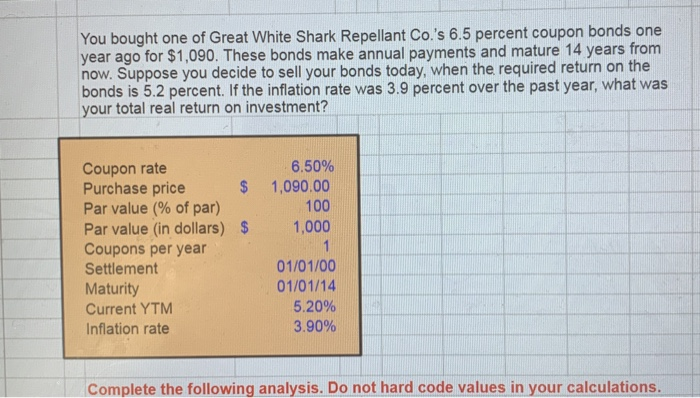

Chapter 7 Flashcards | Quizlet Suppose that today you buy a bond with an annual coupon of 7 percent for $1,090. The bond has 14 years to maturity. A) What rate of return do you expect to earn on your investment? Assume a par value of $1,000. B) What is the HPY on your investment? (your realized return is known as the holding period yield)

![Solved . Calculating Returns [LO1] Suppose you bought a bond ...](https://media.cheggcdn.com/media%2F38b%2F38b38db3-3702-4add-a10f-4ff659ba85af%2FphpsDljP0.png)

![Answered: 4. Calculating Returns [LO1] Suppose… | bartleby](https://content.bartleby.com/qna-images/question/4ed9bdea-3a41-49ec-a684-f00d4b6b8d3d/8fd2ac2f-5447-46a5-acf3-3441dc616c9a/0aq6elm.png)

Post a Comment for "42 suppose you bought a bond with an annual coupon of 7 percent"