45 present value of coupon bond

Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $1,033 Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation The formula for coupon bond can be derived by using the following steps:

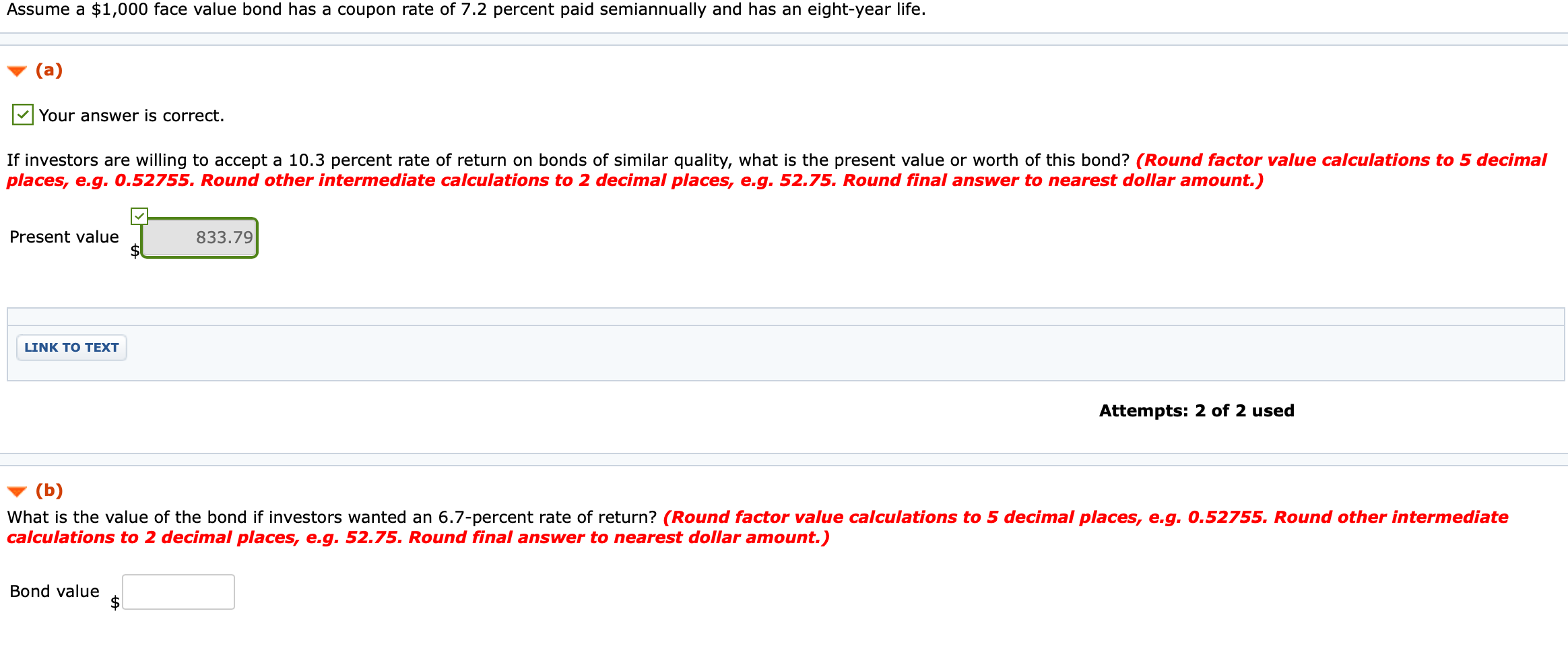

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market.

Present value of coupon bond

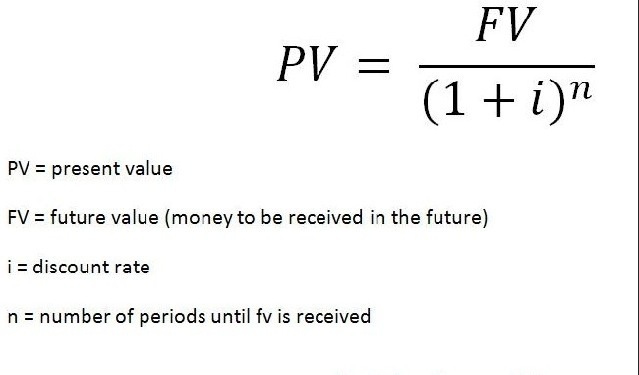

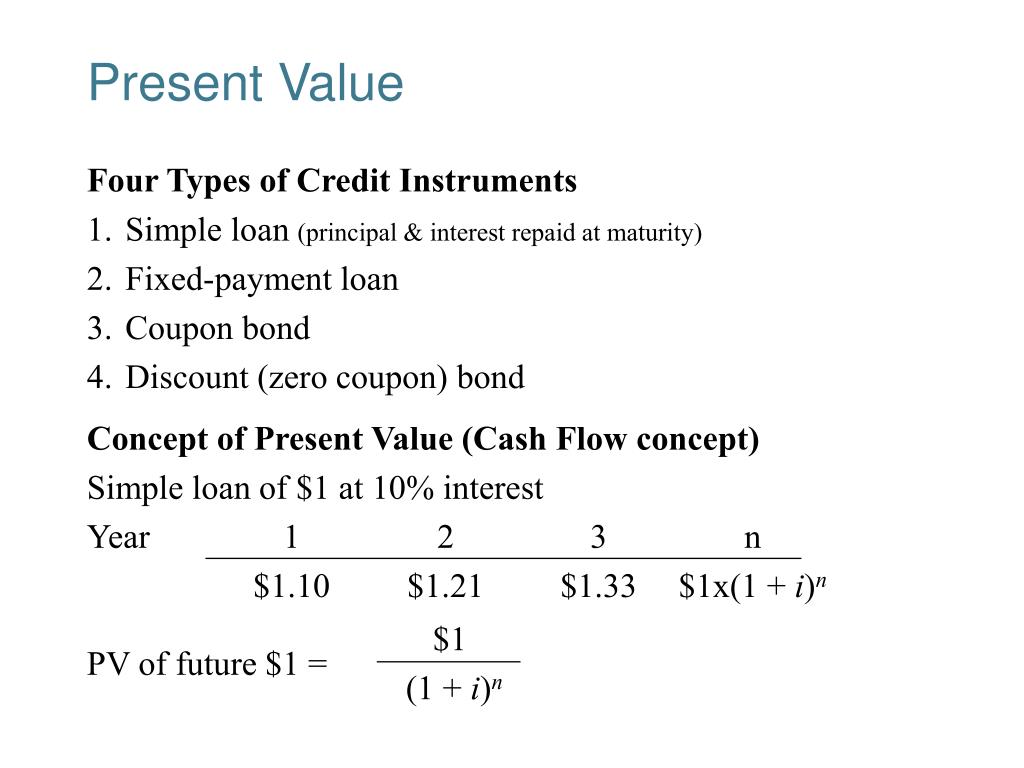

What Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%. The investor pays 816 today and receives the face value of the bond (1,000) at the maturity date, as shown in the cash flow diagram below. Zero Coupon Bond Rates Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... Par Value = $ 1,000 Maturity Date is in 5 years Annual Coupon Payments of $100, which is 10% Market Interest rate of 8% The Present Value of the Coupon Payments ( an annuity) = $399.27 The Present Value of the Par Value ( time value of money ) =$680.58 The Present Value of a Bond = $ 399.27 + $ 680.58 = $1,079.86

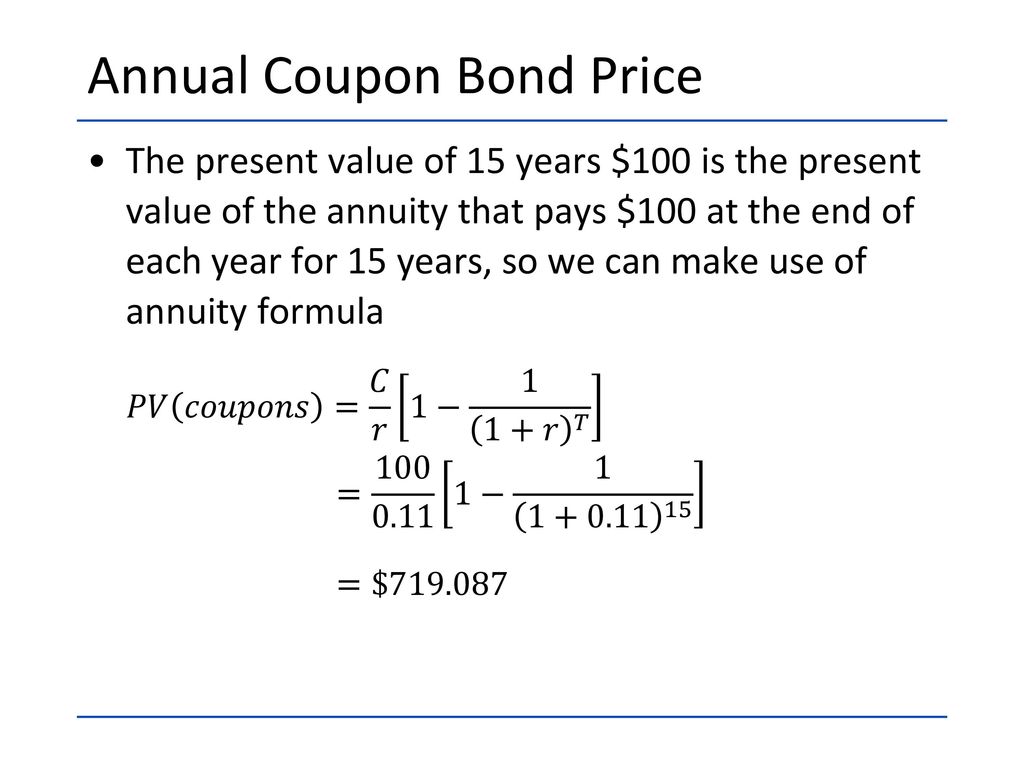

Present value of coupon bond. Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity ... Investment Banking, Financial Modeling & Excel Blog The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Let's say a $50,000 bond with a 5% coupon rate pays $2,500 in annual interest, irrespective of the bond's current price. However, if the interest rate increases to, say, 7%, the newly issued bonds with a $50,000 face value will pay an annual interest of $3,500. That means the 5% bond is hardly affected by the secondary market. Solved What is the present value of coupon bond with a face - Chegg Economics questions and answers. What is the present value of coupon bond with a face value of $8,000 that matures in 3 years. The bond comes with three coupons that pay $250, $300, and $350 at the end of the 1st, 2nd, and 3rd year, respectively. The equil interest rate is 4%. Round your intermediate and final answers to the nearest cent two ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Bond Valuation Overview (With Formulas and Examples) To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42 A natural question one would ask is, what does this tell me? Find the present value of a 30 year bond that pays an - Course Hero The present value of a a 30-year bond is the present value of all coupon payments and principal discounted at 5% = €1153.73. The Pv of €1 annuity for 30 years discounted at 5% =15.3. The Pv of €1 receivable at the end of 30th year discounted at 5% =0.2313. Bond value = €60*15.3+€1000*.2313. =€1153.73 Solved 1. Calculate the present value of a $1000 zero-coupon - Chegg This problem has been solved! 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity.

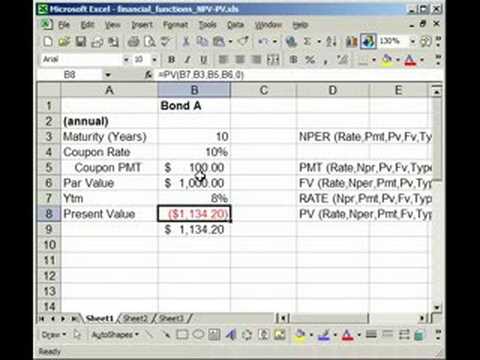

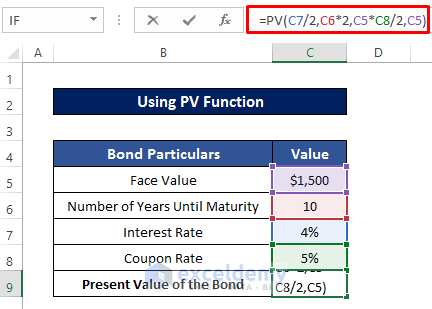

How to Calculate Bond Price in Excel (4 Simple Ways) Users can calculate the bond price using the Present Value Method ( PV ). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation Bond Price Calculator | Formula | Chart 20.06.2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the following … Corporate Bond Valuation - Overview, How To Value And Calculate Yield A common way to visualize the valuation of corporate bonds is through a probability tree. Consider the following example of a corporate bond: 3-year maturity $1,000 face value 5% coupon rate ($50 coupon payments paid annually) 60 payout ratio ($600 default payout) 10 probability of default 5% risk-adjusted discount rate What Is Bond Valuation? - The Balance How Bond Valuation Works . A bond's face value, or par value, is the amount an issuer pays to the bondholder once a bond matures. The market price of a bond, which equals the present value of its expected future cash flows, or payments to the bondholder, fluctuates depending on a number of factors, including when the bond matures, the creditworthiness of the bond issuer, and the coupon rate ...

How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

Valuing Bonds | Boundless Finance | | Course Hero The formula for calculating a bond's price uses the basic present value (PV) formula for a given discount rate. Bond Price: Bond price is the present value of coupon payments and face value paid at maturity.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest

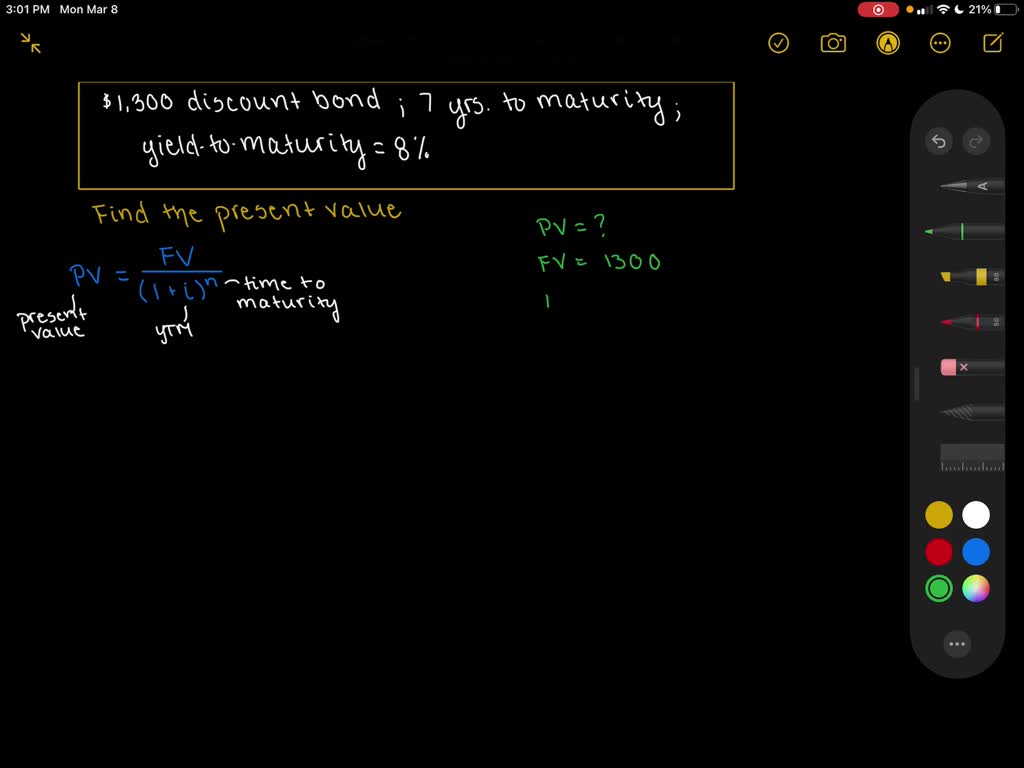

calculate the present value of a 1300 discount bond with seven years to maturity if the yield to mat

Calculating Present and Future Value of Annuities - Investopedia 25.04.2022 · The present value is how much money would be required now to produce those future payments. Two Types of Annuities Annuities, in this sense of the word, break down into two basic types: ordinary ...

Present Value Factor Formula | Calculator (Excel template) Now, in order to understand which of either deal is better i.e. whether Company Z should take Rs. 5000 today or Rs. 5500 after two years, we need to calculate a present value of Rs. 5500 on the current interest rate and then compare it with Rs. 5000, if the present value of Rs. 5500 is higher than Rs. 5000, then it is better for Company Z to take money after two years otherwise take Rs. 5000 ...

Excel formula: Bond valuation example | Exceljet In the example shown, we have a 3-year bond with a face value of $1,000. The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. ... The value of an asset is the present value of its cash flows. In this example we use the PV function to calculate the present value of the 6 equal payments plus the ...

Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... For example, find the present value of a 5% annual coupon bond with $1,000 face, 5 years to maturity, and a discount rate of 6%. You should work this problem on your own, but the solution is ...

Bond Pricing Formula | How to Calculate Bond Price? | Examples Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically …

What Are Bonds and How Do They Work? - The Balance 03.07.2022 · Face value: Also known as "par value," this is a static value assigned when a company brings stock or a bond to market. Unlike market value, face value doesn’t change. You’ll find the par value printed on the stock or bond certificate. Coupon rate: The nominal or stated rate of interest on a fixed-income security, like a bond. This is the ...

Coupon Payment Calculator How to calculate bond coupon payment? Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.

Coupon Rate of a Bond - WallStreetMojo Par value of bond = $1,000 Annual interest payment = 4 * Quarterly interest payment = 4 * $15 = $60 Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount .

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Present Value Formula | Calculator (Examples with Excel … Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ...

How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

1. What is the future value of the pure discount loan | Chegg.com Suppose your new Model X costs $100k. If you finance it at 10% for five years, Firstly, a pure discount loan will ask a lump-sum payment at the end: ( Secondly, an amortized loan will ask an equally-splitted payment every period: Thirdly, a coupon bond will pay interest periodically and principal at the end: Previous question.

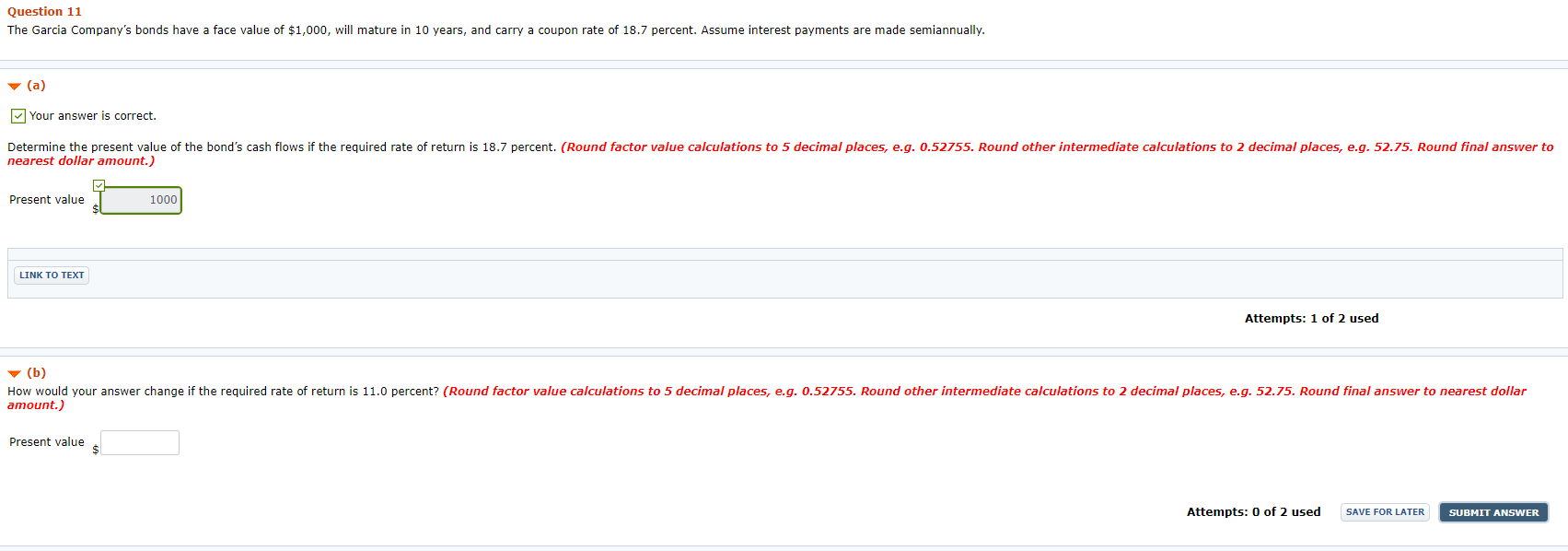

Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

Excel formula: Present value of annuity | Exceljet rate - the value from cell C7, 7%. nper - the value from cell C8, 25. pmt - the value from cell C6, 100000. fv - 0. type - 0, payment at end of period (regular annuity). Annuity due. With an annuity due, payments are made at the beginning of the period, instead of the end. To calculate present value for an annuity due, use 1 for the type ...

Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... Par Value = $ 1,000 Maturity Date is in 5 years Annual Coupon Payments of $100, which is 10% Market Interest rate of 8% The Present Value of the Coupon Payments ( an annuity) = $399.27 The Present Value of the Par Value ( time value of money ) =$680.58 The Present Value of a Bond = $ 399.27 + $ 680.58 = $1,079.86

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%. The investor pays 816 today and receives the face value of the bond (1,000) at the maturity date, as shown in the cash flow diagram below. Zero Coupon Bond Rates

What Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

/bond-valuation_final-17baab1858d741cd88a6e86402933dce.jpg)

Post a Comment for "45 present value of coupon bond"