38 find the coupon rate of a bond

What Is a Coupon Rate? How To Calculate Them & What They ... Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Find the coupon rate of a bond

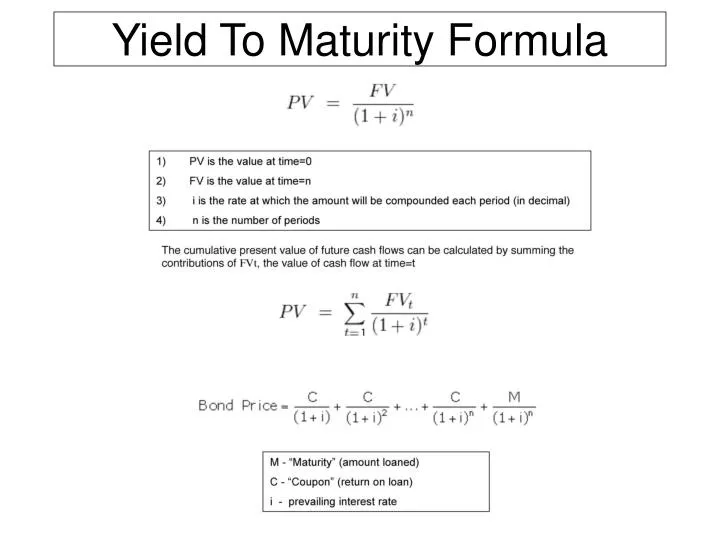

Definition Of Bond Discount Rate | KOVNER CENTER FOR ... The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. How To Calculate A Coupon Payment. If the maturity date was one year from when you loaned your friend the money, then you would receive $1,100 at maturity. For example, ABC Corporation could issue a 10-year, zero-coupon ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

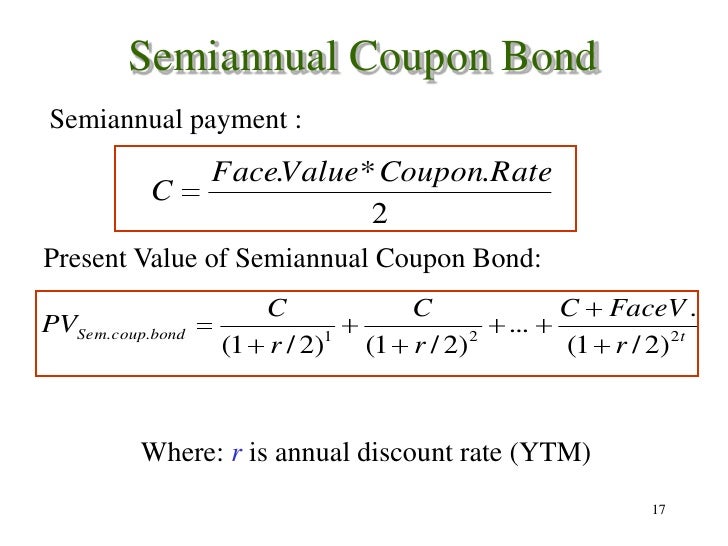

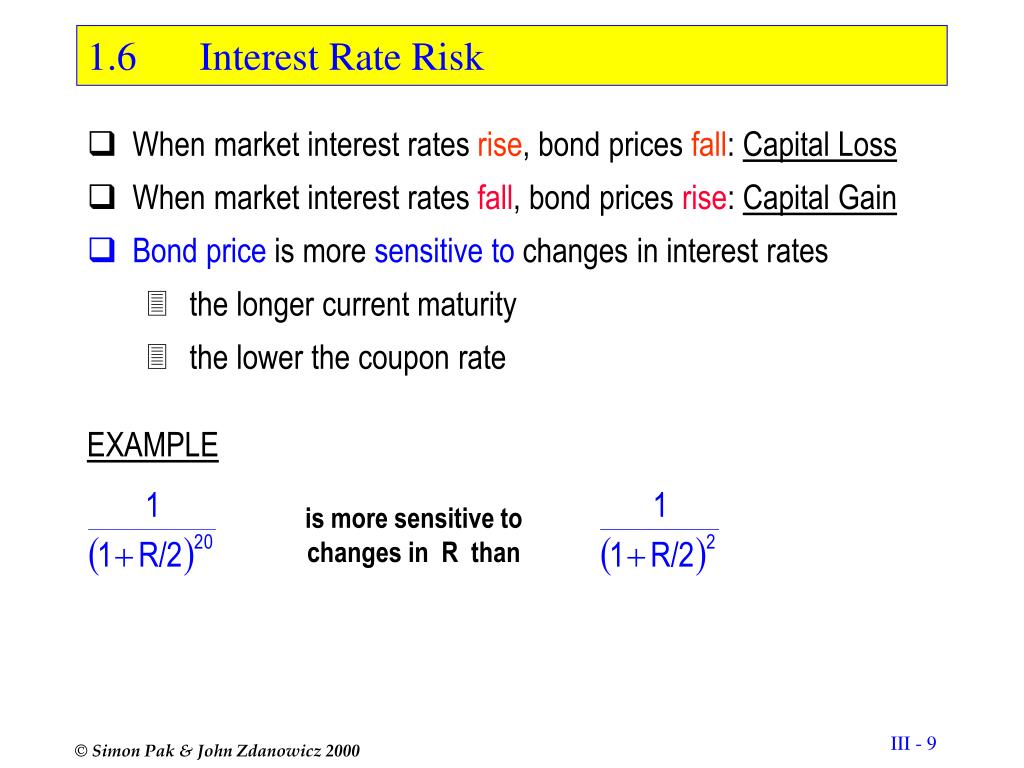

Find the coupon rate of a bond. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! Bond Coupon Rate Calculator Answered: You find a bond with 27 years until… | bartleby You find a bond with 27 years until maturity that has a coupon rate of 9.0 percent and a yield to maturity of 8.1 percent. Suppose the yield to maturity on the bond increases by .25 percent. a. What is the new price of the bond using duration and using the bond pricing formula? (Do not round intermediate calculations. What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value. For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. How to Calculate Coupon Rates | Sapling To calculate bond coupon rates, use the formula C = i/P, where "C" represents the coupon rate, "i" represents the annualized interest rate and "P" represents the par value, which is the principal amount (or face value) of the bond. The coupon rate is based on a bond's face value, not current yield.

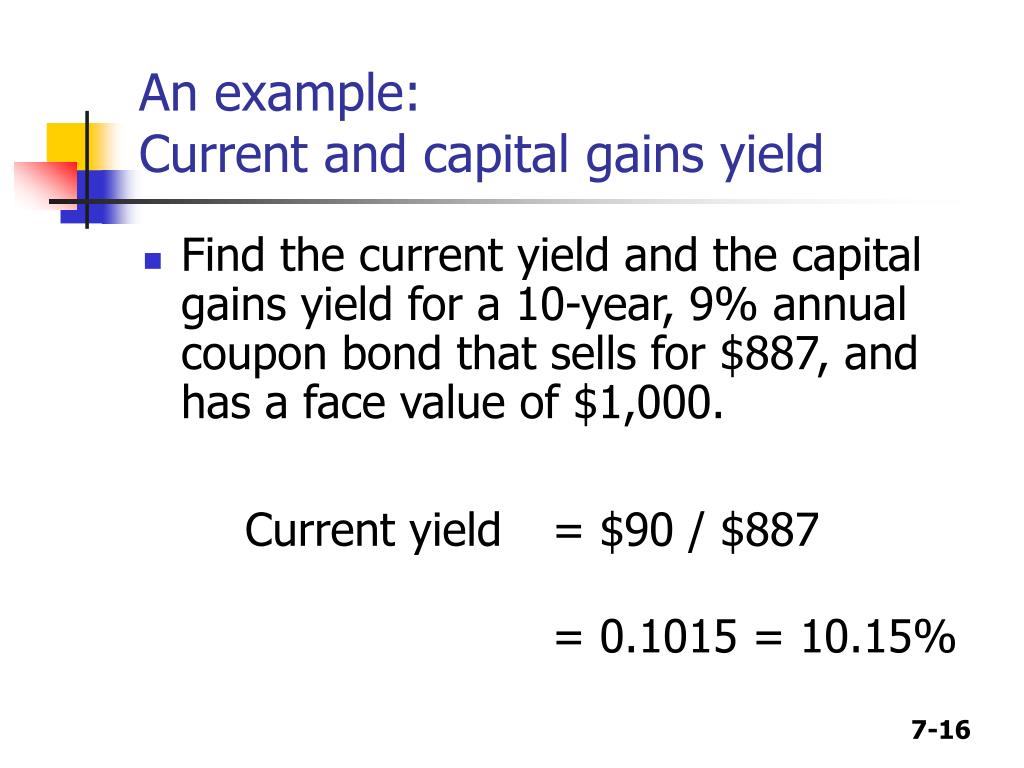

Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Zero-Coupon Bond: Formula and Excel Calculator In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond's cash flows equal to the current market price. To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Answered: A coupon bond has two years to… | bartleby A coupon bond has two years to maturity, a face value of $1000 and a coupon rate of 2%. The yield to maturity is 3%. After one year, the yield to maturity falls to 2%. Find the rate of capital gain for the first year. What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bond Calculator | Calculates Price or Yield The coupon rate is the rate of interest a bond pays annually. (Coupon interest, however, is most frequently paid semiannually.) To determine the dollars of interest paid annually, multiply the par value by the coupon rate. The call date (if a bond is callable) is essential information when evaluating a bond. Coupon Bond Formula | Examples with Excel Template Calculate the market price of the bonds based on the given information. Solution: Coupon (C) is calculated using the Formula given below. C = Annual Coupon Rate * F C = 5% * $1000 C = $50 Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t]

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate Definition A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments. equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

Bond Price Calculator n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Find the coupon date of a bond - Stack Exchange It will pay periodic coupons starting from the issue date. You can also work backwards from the maturity date. In your example the bond matures on March 6, 2022 and pays interest annually (although I find conflicting data from other sites) so it pays interest every March 6th (plus or minus a few days depending on what the prospectus says).

Post a Comment for "38 find the coupon rate of a bond"