45 what is coupon for bond

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount Bond Will Be Traded At A Discount A discount bond is one that is issued for less than its face value. It also refers to bonds whose coupon rates are lower than the market interest rate and thus trade for less than their face value in the secondary market. read more. study.com › learn › zero-coupon-bond-questions-andZero Coupon Bond Questions and Answers - Study.com A 1-year zero coupon Treasury bond sells for $988.14 and a 2-year zero coupon Treasury bond sells for $970.66. If you buy a 2-year 5% annual coupon bond today, and one year from now immediately fol...

Zero Coupon Bond Calculator - What is the Market Price ... A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond.

What is coupon for bond

Difference Between Coupon Rate and Discount Rate (With ... Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. Loan Process: If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond. › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon Jan 02, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. What Is Coupon Rate and How Do You Calculate It? A bond coupon rate is a fixed payment, meaning that it will remain the same for the lifetime of the bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

What is coupon for bond. Coupon Rate Definition - investopedia.com The coupon rate is the interest rate paid on a bond by its issuer for the term of the security. The term "coupon" is derived from the historical use of actual coupons for periodic interest payment ... Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money Time Value of Money The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ... Floating Rate Bonds: Characteristics, Rate, and Important ... Fixed-rate bonds lose the charm for investors when interest rates rise, as the investors can purchase another bond with higher coupon rates. Floating-rate bonds eliminate that factor of uncertainty for investors. As the coupon payments adjust with interest rate changes, the investors are less exposed to the opportunity cost.

miniwebtool.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator - MiniWebtool Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula. The zero ... What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder. What Is the Coupon Rate of a Bond? The coupon rate of a bond or other fixed income security is the interest rate paid out on the bond. When the government or a company issues a bond, the rate is fixed. The coupon rate is stated as an annual percentage rate based on the bond's par, or face value. The dollar amount represented by this coupon rate is paid each year—usually on a ... Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

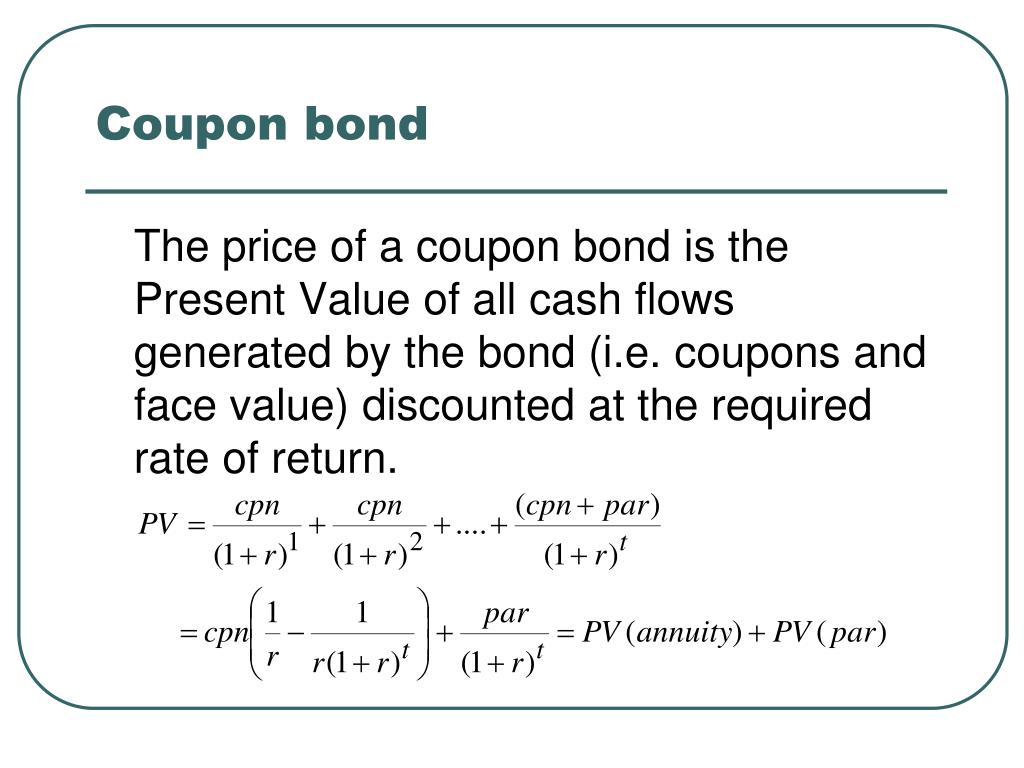

Coupon Bond Formula | How to Calculate the Price of Coupon ... What is Coupon Bond Formula? The term " coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more " refers to bonds that pay coupons which is a nominal percentage of the par value or ... Coupon Bond Definition & Example - InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying you $50 per year. To claim your interest payment, you would simply clip off the ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

What Is a Bond Coupon? - The Balance How Bond Coupons Work Today . Technology has changed the process of investing in a bond. The need for paper coupons is no more. But the term is still used. A bond's coupon refers to the amount of interest due and when it will be paid. A $100,000 bond with a 5% coupon pays 5% interest.

Coupon Rate - Meaning, Calculation and Importance The coupon rate for bonds is the interest bond issuer pays on the face value of the bond. In other words, it is the periodic interest that the issuer of the bond pays the bond buyer. The couponrate of a bond is computed on the face value of the bond. And not on the market price or the issue price.

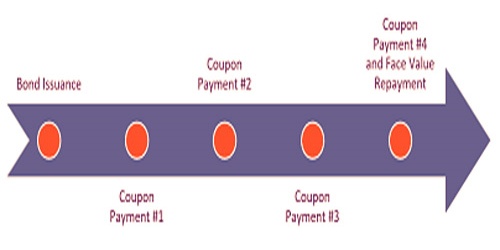

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What Is a Coupon Rate? How To Calculate Them & What They ... A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value.

Coupon Bond - Definition, Terminologies, Why Invest? Coupon bonds are a type of bond that pay fixed interest (coupons) at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond's nominal value and ...

› terms › cCoupon Bond - investopedia.com Mar 31, 2020 · A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of ...

What are Deferred Coupon Bonds? And Why Investors invest ... The investors' attraction with deferred coupon bonds is to receive the coupon or interest later on or to resell the bond immediately above $95. The investors will be able to sell the deferred bond in the market if the interest rates fall. A lower interest rate will make a new bond issued at full par value less attractive in the market, which ...

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that provides profit for the investor when it reaches maturity. Unlike traditional bonds, zero-coupon securities don't provide interest payments during the life of the bond. Instead, investors make money on these bonds when they buy them at a deep discount.

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. This figure is used to see whether the bond ...

Coupon Bond Formula | Examples with Excel Template Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

› terms › zZero-Coupon Bond Definition - Investopedia Feb 26, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is ...

What Is Coupon Rate and How Do You Calculate It? A bond coupon rate is a fixed payment, meaning that it will remain the same for the lifetime of the bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

› bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon Jan 02, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Difference Between Coupon Rate and Discount Rate (With ... Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. Loan Process: If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond.

Post a Comment for "45 what is coupon for bond"